Table of Contents

When carbon emissions cost money, we produce less of them—but there's more to the story.

What is carbon pricing?

“Carbon pricing” is a market-based strategy for lowering global warming emissions. The aim is to put a price on carbon emissions—an actual monetary value—so that the costs of climate impacts and the opportunities for low-carbon energy options are better reflected in our production and consumption choices. Carbon pricing programs can be implemented through legislative or regulatory action at the local, state, or national level.

The fossil fuels (coal, oil, and natural gas) we use to generate electricity, power our vehicles, and heat our homes all produce carbon dioxide emissions, which are a leading cause of climate change. In most cases, the costs of climate impacts—including public health and damage costs of heatwaves, flooding, heavy downpours, and droughts—are borne by taxpayers and by individuals who are directly affected, but aren’t taken into account in decisions made by producers or consumers of carbon-intensive goods.

Putting a price on carbon helps to incorporate climate risks into the cost of doing business. Emitting carbon becomes more expensive, and consumers and producers seek ways to use technologies and products that generate less of it. The market then operates as an efficient means to cut emissions, fostering a shift to a clean energy economy and driving innovation in low-carbon technologies. Complementary renewable energy and energy efficiency policies are also critical to cost-effectively drive down emissions.

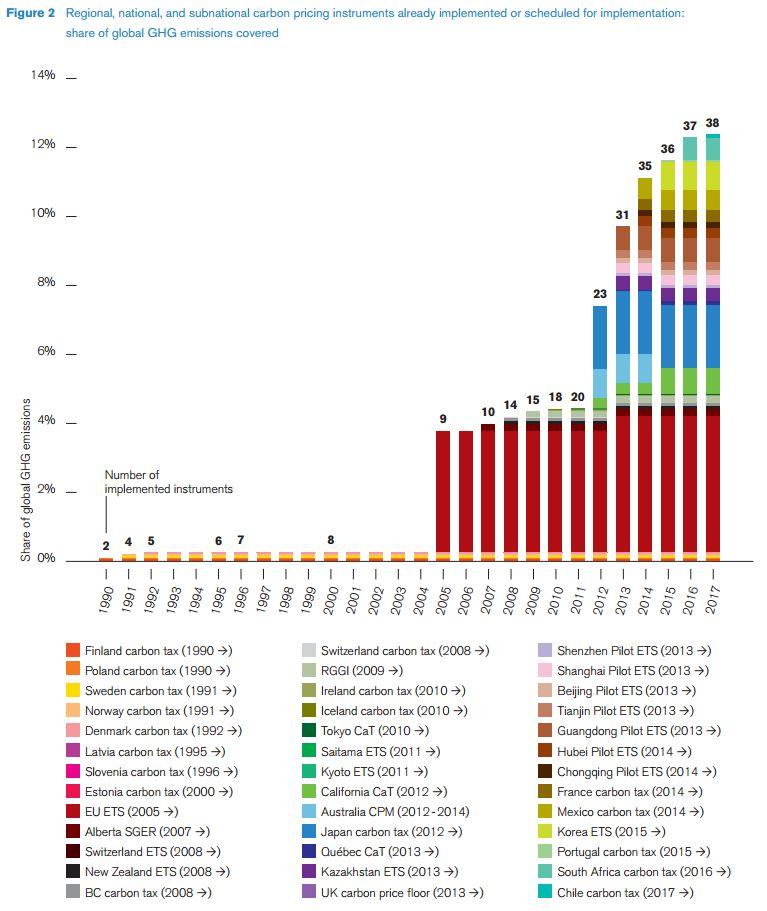

Carbon pricing is widely considered a powerful, efficient, and flexible tool for helping to address climate change, and is supported by an array of experts, businesses, investors, policymakers, civil society groups, states, and countries. Carbon pricing programs are already in use in many states and countries, including in California, the nine Northeast states that belong to the Regional Greenhouse Gas Initiative, and Europe.

How does carbon pricing work?

There are broadly two ways to put a price on carbon:

Under a cap-and-trade program, laws or regulations would limit or ‘cap’ carbon emissions from particular sectors of the economy (or the whole economy) and issue allowances (or permits to emit carbon) to match the cap. For example, if the cap was 10,000 tons of carbon, there would be 10,000 one-ton allowances. A declining emissions cap would help reduce emissions over time.

Every source of emissions subject to the cap (for example, power plants or refineries) would be required to hold allowances equal to the emissions they produce. Power plant operators could acquire allowances through an auction (where they bid for the allowances they need) or allocation (where they are given a set number of allowances for free).

Once these entities have allowances, they would be able to trade or sell allowances freely among themselves or other eligible market participants. Because the allowances are limited and therefore valuable, those subject to the cap will try to cut their emissions as a way to reduce the number of allowances they have to purchase. The resulting interaction between the demand and supply of allowances in the market determines the price of an allowance (also known as the carbon price).

With a carbon tax, laws or regulations are enacted that establish a fee per ton of carbon emissions from a sector or the whole economy. Owners of emissions sources subject to the tax would be required to pay taxes equivalent to the per-ton fee times their total emissions. Those who can cut emissions cost-effectively would reduce their tax payments. Those subject to the tax would have an incentive to lower their emissions, by transitioning to cleaner energy and using energy more efficiently. A rising carbon tax would help ensure a decline in emissions over time.

Hybrid approaches include programs that limit carbon emissions but set bounds on how much the price can vary (to prevent prices from dropping too low or rising too high). Another hybrid approach adjusts the tax to ensure specific emission reduction goals are met. A third hybrid approach could be when a jurisdiction implements a carbon cap-and trade program for some sectors and applies a carbon tax on others. Carbon pricing programs can also work in a complementary manner with other renewable energy and energy efficiency policies, such as renewable electricity standards, energy efficiency standards, and vehicle fuel economy rules.

Gasoline taxes, severance taxes for coal mining and natural gas or oil drilling, or policies that incorporate a social cost of carbon are examples of other ways of indirectly factoring a price on carbon into consumer or business decisions.

From an economic perspective, both carbon tax and a cap-and-trade systems function in equivalent ways: one sets a price on emissions which then determines the level of emissions, the other sets the level of emissions, which determines a price for those emissions. The level of the tax or cap and its rate of increase (for a tax) or decline (for a cap) over time drives the degree to which emissions are cut. Designed well, both of these approaches can deliver on the main aim of a robust carbon pricing program, which is to help cut emissions cost-effectively in line with climate and energy goals. However, there may be important policy or political reasons to prefer one or the other in a particular context, such as voter preferences or limits on regulatory or legislative authority.

Economic benefits

Both a carbon tax and a cap-and-trade program with auctioned allowances can generate significant revenues. The use of these revenues has important implications for distributional fairness and economic growth. Potential uses of carbon revenues could include one or more of the following:

- Offsetting the disproportionate impacts of higher energy prices for low-income households (e.g. through rebates on electricity bills for low and moderate income households)

- Providing transition assistance to workers and communities that depend on fossil fuels for their livelihoods (e.g. funding for job training and investments in economic diversification)

- Investing in renewable energy; clean vehicles, fuels, and transit options; and energy efficiency to speed the shift to a clean energy economy and drive down consumer costs

- Investing in communities that face a disproportionate burden of pollution from fossil fuels

- Creating an opportunity to cut other taxes such as payroll, sales, or corporate taxes and make up for that through carbon revenues

- Reducing the deficit

- Per capita dividends (e.g. annual checks) for all Americans, paid for by dividing some or all of the carbon revenues

- Investing in climate-resilient infrastructure (e.g. upgraded roads and sea walls) or relocation costs for communities at high risk

- Contributing to efforts to cut carbon and prepare for climate change in developing countries

A program that returns all the revenues directly to taxpayers is called revenue-neutral. Revenues can be returned in a variety of ways, including through tax cuts or per capita dividends.

Science considerations

A robust carbon cap or tax should put the economy on a trajectory toward the science-based deep cuts in emissions required to limit some of the worst impacts of climate change. Informed by the 2014 Intergovernmental Panel on Climate Change Fifth Assessment Report and the 2015 Paris Agreement reached under the United Nations Framework Convention on Climate Change, the overarching U.S. goal should be to reach net zero carbon emissions (i.e. any remaining emissions must be offset by increased biological or geological sequestration) by mid-century. The country can get on this pathway by setting strong interim emission reduction targets for major carbon-emitting sectors, implementing complementary renewable energy and energy efficiency policies, and through state or regional measures.

Equity concerns

Putting a price on carbon has an economy-wide effect, and good policy design requires addressing potential equity implications. These equity concerns include: the regressive impact of potential energy price increases on low-income households; the potential for carbon pricing policies to allow some fossil fuel-fired power plants or refineries to continue to operate and emit air and water pollutants in neighborhoods already burdened by pollution; and the economic hardship to workers and communities dependent on fossil fuel industries for livelihoods or for their tax base as we transition away from these resources.

Carbon revenues can provide a source of funding for helping to address these concerns, alongside other targeted policies. For example:

- Rebates and energy efficiency measures designed for low income or fixed income households can help ensure they do not pay a disproportionate share of the cost of cutting carbon.

- Disenfranchised communities are often hit hardest by pollution from the fossil energy sector. That pollution can be limited by pairing a carbon pricing policy with investments in local clean energy and efficiency initiatives, tighter controls of ambient air and water pollutants and toxics, and incentives for retiring coal-fired power plants.

- Workers and communities affected by the move away from fossil fuels should receive transition assistance through worker training programs, economic diversification initiatives, and funding for retiree benefits that may be adversely affected as fossil companies change their business models.

Carbon pricing in action

The U.S. sulfur dioxide trading program, established as part of the Acid Rain program, is a pioneering example of using the market to drive down pollution. Carbon cap-and-trade programs are already working successfully in California and the nine Northeast and Mid-Atlantic states that participate in the Regional Greenhouse Gas Initiative (RGGI). These states also have complementary renewable energy and energy efficiency policies that work together with the carbon price to cut emissions. Many more states are considering carbon trading programs as part of their compliance plans for the Clean Power Plan.

The world’s first carbon cap-and trade program, launched in 2005, is the European Union’s Emissions Trading Scheme (EU-ETS). The Canadian province of British Columbia implemented a carbon tax in 2008. China has also launched a number of pilot cap-and-trade programs at the provincial level and intends to launch a national trading program within the next few years.

Many big companies are already using an internal price on carbon to inform their business decisions. A growing list of companies have also voiced support for a policy to put a price on carbon, including Apple, Google, BP, Royal Dutch Shell, Unilever, and Nestlé. Companies and investors need to reorient their business models toward a low-carbon economy, while supporting the implementation of a robust carbon price.

With growing recognition of the urgent need to address climate change, momentum for adopting carbon pricing programs is likely to increase in the years ahead both in the U.S. and globally.